In response to the impacts of global climate change, ECOVE recognizes that climate change may pose both risks and opportunities for our related businesses. Therefore, starting in 2020, we have implemented the management framework recommended by the Task Force on Climate-related Financial Disclosures (TCFD). This framework encompasses four core elements: governance, strategy, risk management, and metrics and targets. We continuously assess climate change risks related to our operations each year, adapting to the latest international developments to enhance the organization's resilience in addressing climate change. In 2024, we have incorporated the International Sustainability Standards Board’s (“ISSB”) IFRS S2 on Climate-related Disclosures, which was published in June 2023. The Company has assessed the standards and simultaneously complete the independent report (Publications - ECOVE Environment Corporation)(Hyperlink to be added).

Climate Governance and High-Level Management

The climate governance mechanism of ECOVE is overseen by the Board of Directors as the highest governing body, and relevant responsibilities are executed through the Sustainability Development Committee and the Risk Management Executive Committee. The "Sustainability Development Committee" of ECOVE is responsible for coordinating corporate social responsibility, environmental protection (including climate-related risks and opportunities), and corporate governance matters. However, regarding the risks faced during operations, the "Risk Management Guidelines" issued in 2017 (which cover "information security risks," "health and safety environmental risks," "operational risks," "quality management risks," and "climate and natural risks") is the legal source to establish the "Risk Management Executive Committee" and formulate the "Risk Management Policy" as the highest guiding principle and management procedure for the Company's risk management. The executive committee is required to report to the Board of Directors at least once a year. Since the "Risk Management Executive Committee" serves as the decision-making body for the Company's risk management, the environmental protection-related risks assessed by the Sustainability Development Committee (including climate-related risks and opportunities) are also integrated into the Company's overall risk management process. The Chairman of the Board serves as the chief supervisor of the Sustainable Development Committee, with the President serving as the chairman of the committee. Members include the Chairmen and Presidents of the subsidiary companies. The committee is divided into three main groups: social participation, environmental protection, and corporate governance. Each group sets annual work objectives (encompassing climate indicators and the status of target execution) to fulfill corporate responsibilities. At the end of each year, the committee reports to the Board of Directors on the "results of the current year's execution and the work plan for the next year," enabling the Board to fully grasp the Company's achievements and plans regarding social responsibility, corporate governance, and the execution of climate goals. After hearing the report, the Board may provide necessary guidance and urge relevant adjustments as needed to effectively fulfill its supervisory responsibilities.

Meanwhile, in order to ensure that Board members continue to have climate and environmental stewardship, all members of the Board of Directors of the Company have completed relevant training in accordance with the "Guidelines for Continuing Education for Directors and Supervisors of Exchange-listed and OTC-listed companies." The training sessions are coordinated by the Group's Secretariat of the Board of Directors in accordance with the needs of the directors' professional functions or external trends. The training content covers corporate governance, business ethics and compliance, risk management, corporate sustainability, information security, and climaterelated issues, etc., aiming to enhance the Board's understanding and supervision capability of emerging issues, as well as the effectiveness of corporate governance.

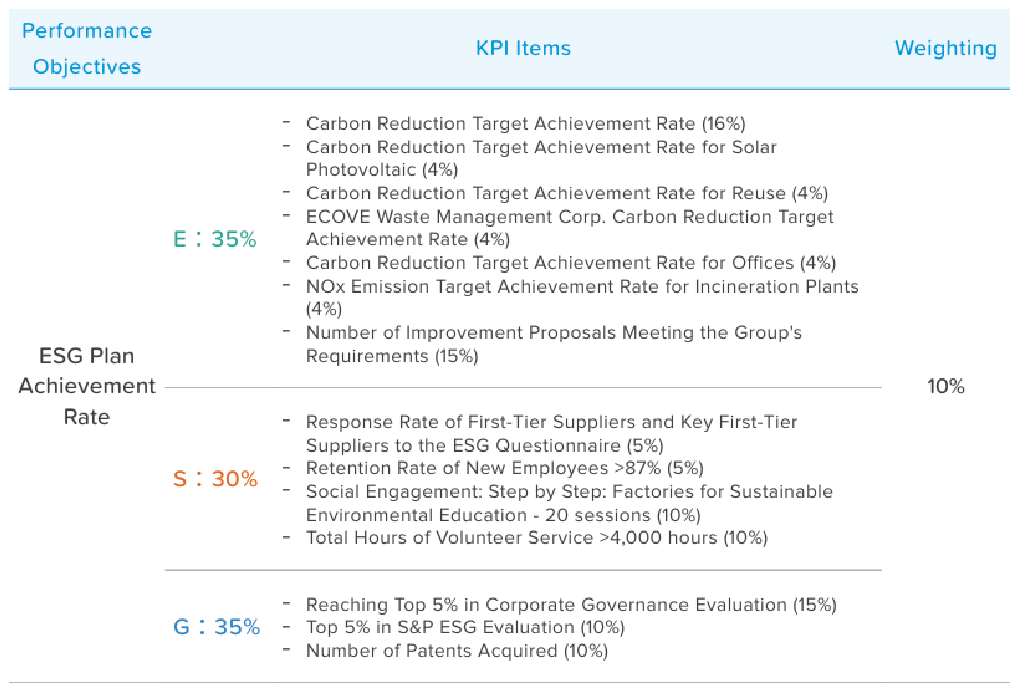

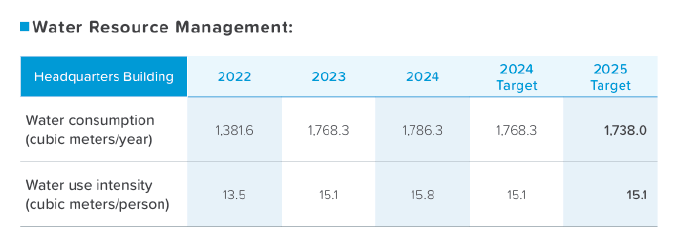

The remuneration of the Company's directors and managers follows the guidelines and criteria set forth by

the Remuneration Committee and the Board of Directors, including the "Guidelines for Director Performance

Evaluation and Remuneration System" and the "Guidelines for Manager Performance Evaluation and Remuneration

System." The remuneration takes into account industry norms, as well as the Company's performance, individual

contributions, and achievements, aiming to provide reasonable compensation. It covers the achievement of various

of inancial targets (accounting for approximately 65% of the total) and non-financial performance indicators (accounting for approximately 35% of the total). The industrial model of ECOVE is highly related to sustainable development, thus linking the sustainable goals to the performance of each executive (including the Chief Executive Officer and other senior executives) and departmental KPIs is one of the factors considered for performance bonus distribution. The required achievement indicators cover the rate of renewable energy generation and the rate of environmental protection (including greenhouse gas reduction). The purpose of the established "Climate Performance Reward System" is to connect sustainable goals with each executive (including the Board of Directors and managers) and align them with departmental performance objectives, thereby strengthening the implementation of the Company's environmental management goals. It also enhances vertical management and communication. By requiring departmental performance objectives, employees are encouraged to set personal environmental performance goals, effectively promoting ESG-related work through a two-way channel from the bottom up and top down, enabling the Company to achieve its established environmental objectives.

Strategies

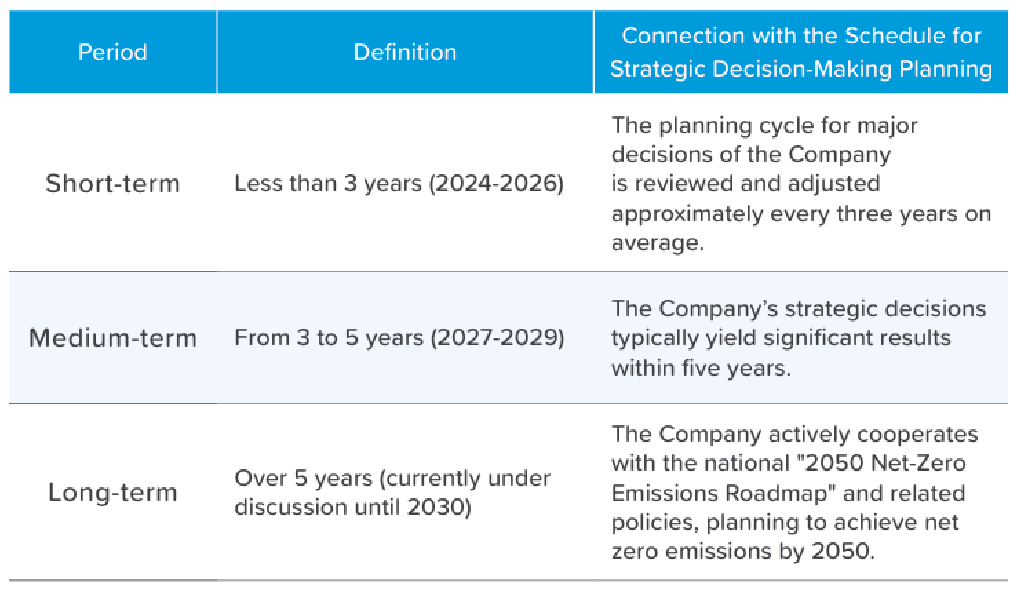

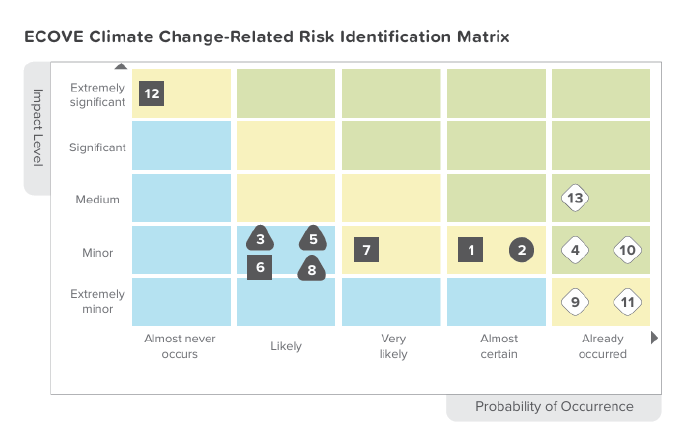

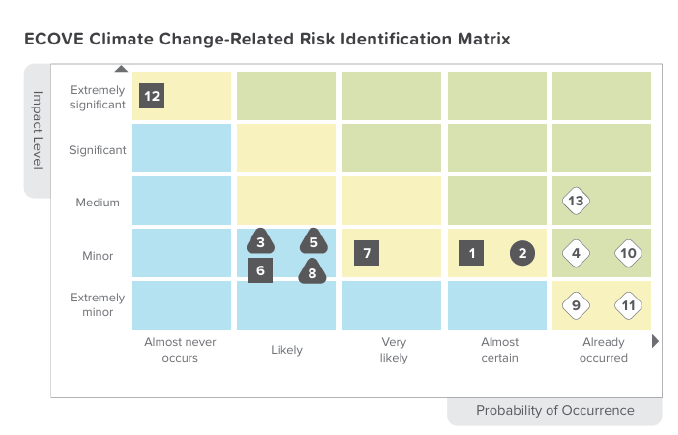

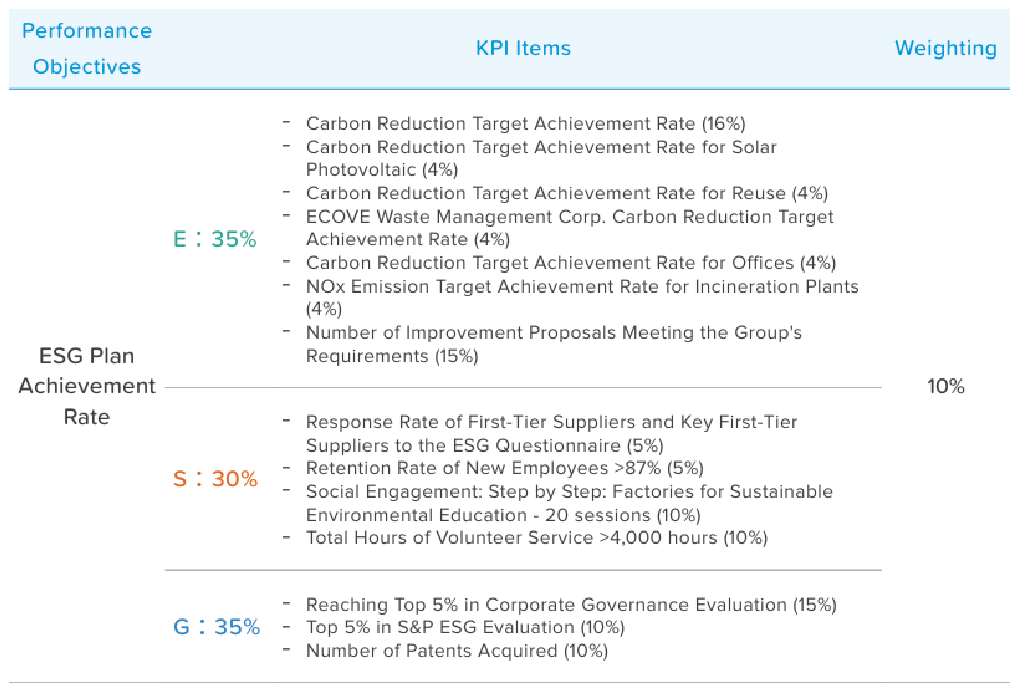

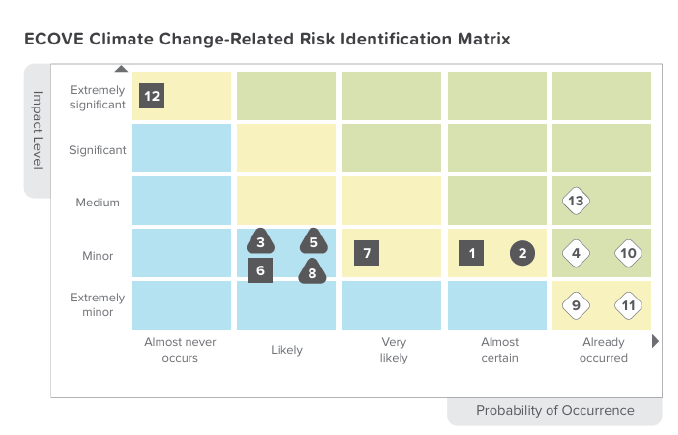

The Company refers to the physical risks outlined by the TCFD (immediate risks - heavy rainfall flooding, water scarcity, strong winds; long-term risks - high temperatures) and transition risks (policy and regulation, market, technology, reputation). Opportunities are categorized into five major areas: resource efficiency, energy sources, products and services, market, and resilience. The assessment of the impact on the overall business and operational aspects of ECOVE will be conducted over different time frames (short-term: within 3 years, medium-term: 3-5 years, longterm: over 5 years) using two evaluation criteria: incidence rate (already occurred, almost certain, very likely, likely, almost unlikely to occur) and impact level (extremely minor, minor, moderate, significant, extremely significant). A risk and opportunity matrix will be created based on these evaluations. The time intervals are detailed in the table below.

Identification of Significant Climate Risks and Opportunities

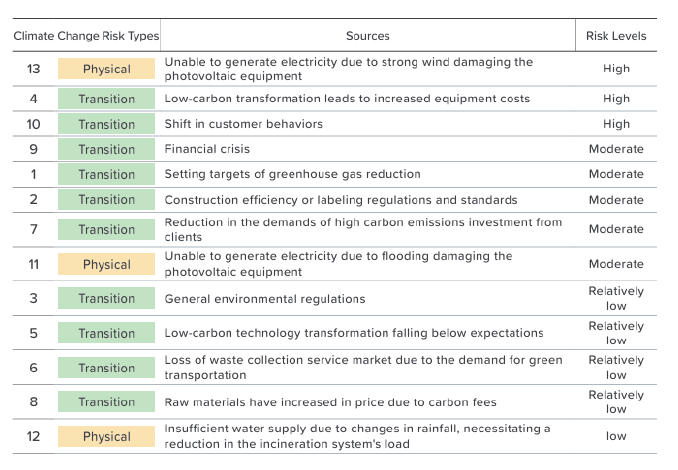

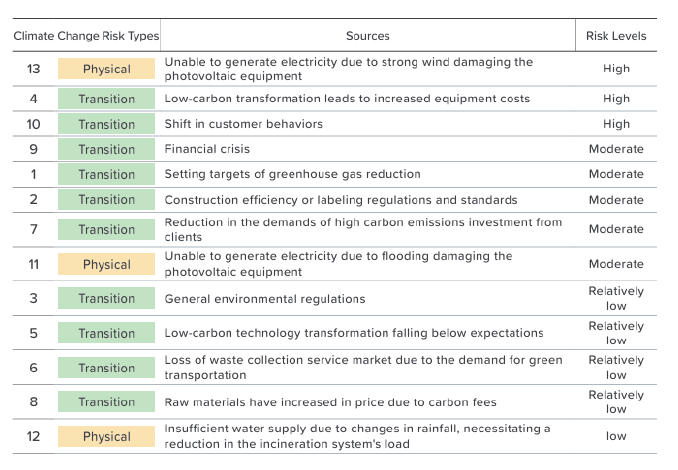

ECOVE's climate-related risk issues encompass a total of 13 items (including 10 transition risks and 3 physical risks). After a systematic assessment, 3 significant climate risks were ultimately identified. ECOVE follows the Task Force on Climate-related Financial Disclosures (TCFD) framework to conduct a quantitative analysis of financial risks, assessing their potential impact on operating costs, capital expenditures, and revenue. Based on the characteristics of risks and their likelihood of occurrence, corresponding management measures and adaptation strategies will be formulated to enhance climate resilience and reduce potential financial impacts and operational risks.

After assessment, the impact level of the three major risks is determined to be moderate to minor, and none have caused significant financial impact on the Company. The classification of risk issues is as follows:

(1) Significant risk issues: The transition to a low-carbon economy has resulted in increased equipment costs, changes in customer behaviors, and damage to photovoltaic equipment due to strong winds, leading to an inability to generate electricity. There are three issues in total, all of which have already occurred, thus they are categorized as significant risk issues.

(2) Moderate risk issues: The establishment of greenhouse gas reduction targets, building efficiency/labeling regulations and standards, the reduction of high-carbon investment demands from customers, damage to photovoltaic equipment due to flooding resulting in an inability to generate electricity, insufficient water supply caused by changes in rainfall leading to the need for incineration systems to reduce load, and financial crises are identified. There are six issues in total, all of which are very likely to occur and are anticipated to impose minor impact on the Company, thus they are categorized as moderate risk issues.

(3) Non-significant risk issues: The following four issues are considered non-significant: general environmental regulations, loss of waste disposal service market due to green movement requirements, lower-than-expected transformation to low-carbon technologies, and price increases of raw materials due to carbon fees. These issues have not yet actually occurred, and their anticipated impact on the Company is deemed minor. The probability of occurrence is only possible, and the expected impact on the Company remains minor; therefore, they are classified as non-significant risk issues.

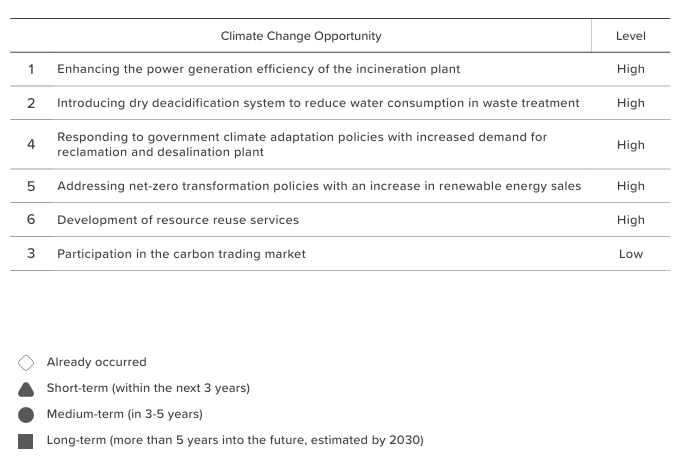

ECOVE's issues on climate-related opportunities encompass six key areas: enhancing the power generation efficiency of incineration plants, introducing dry deacidification system to reduce water consumption in waste treatment, participating in the carbon trading market, responding to government climate adaptation policies with increased demand for reclamation and desalination plant, addressing net-zero transformation policies with an increase in renewable energy sales, and developing reuse services.

(1) Significant opportunities issues: Five issues, namely, enhancing the power generation efficiency of incineration plants, introducing dry deacidification system to reduce water consumption in waste treatment, responding to government climate adaptation policies with increased demand for reclaimed water plants and seawater desalination, addressing net-zero transformation policies with an increase in renewable energy sales, and developing reuse services, are significant because they are the Company's established policies , market demand is high, and the technology has reached maturity.the market demand is high, and the technology has reached maturity.

(2) Non-significant opportunities issues: The topic of participating in the carbon trading market is classified as a nonsignificant issue because it has not yet been incorporated into Company policy, and there remain uncertainties regarding the demand in the carbon trading market and the acceptable market price

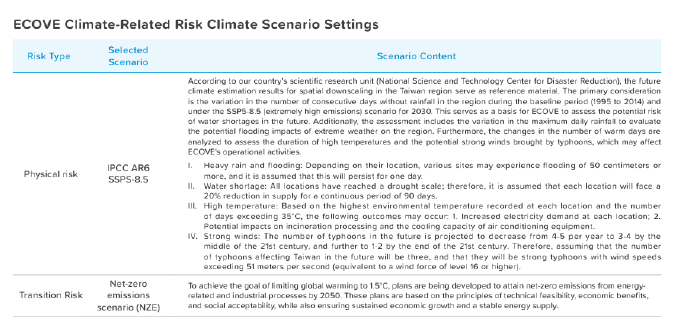

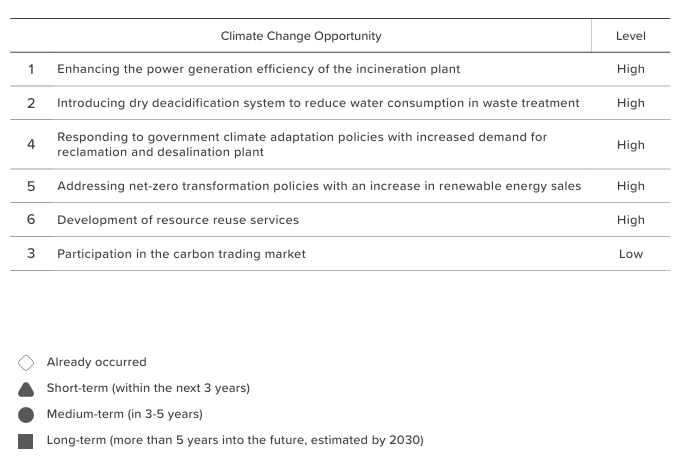

Climate Risk Scenario Analysis

When conducting a physical risk analysis, the impact of climate change varies by geographic location. ECOVE utilizes future climate projection results from Taiwan's scientific research institutions, specifically the National Science and Technology Center for Disaster Reduction (NCDR), as reference data for scenario assumptions regarding spatial downscaling in the Taiwan region. Additionally, the Company employs the Intergovernmental Panel on Climate Change (IPCC) Sixth Assessment Report (AR6), utilizing the latest AR6 warming scenarios and climate projection data. The analysis primarily considers changes in the number of consecutive dry days in the region during the baseline period (1995 to 2014) and the SSP5-8.5 (very high emissions) scenario for 2030 to assess potential water scarcity risks that may arise in the future. Furthermore, it evaluates changes in maximum daily rainfall to assess the potential flooding impacts of extreme weather on the region, as well as changes in the number of warm days to evaluate the duration of high temperatures and their effects on ECOVE's operational activities. Regarding transition risks, ECOVE primarily assesses the impacts on its operations related to low-carbon products and services, changes in customer consumption behavior, the financial system, regulations, and lowcarbon transition issues under a net-zero emissions scenario (NZE) with a temperature increase of 1.5°C.

![]()

Risk Management

In order to effectively assess climate-related risks and opportunities, ECOVE has incorporated climate and natural risk types into its "Risk Management Guidelines." This approach allows for the systematic management of potential risks faced by various operating companies. Following discussions by the "Risk Management Executive Committee," priority risk issues are identified, and control measures are proposed. The climate change risk management representative (a member of the Sustainable Development Committee), based on the results of ECOVE's identification of climate change risks, compiles and reports to the Risk Management Executive Committee on significant or immediate risk issues. The Risk Management Executive Committee shall compile the risk assessment results to be provided as a reference for the audit unit to draw up the annual audit plan. The audit office will report the audit results to the Board of Directors to facilitate the board's monitoring of climate-related issues. In accordance with the "Risk Management Regulations", ECOVE systematically identifies climate risks that may be faced during operations. Climate risk consists of two major types,transformational and physical, which are further differentiated into regulations, technology, market, reputation, and immediate and

long-term. Opportunities are divided into five categories namely, resource efficiency, energy sources, products and services, market, andresilience. The risk and opportunity matrices are evaluated and drawn based on the two consideration factors of incidence rate and level of impact. After discussion by the Risk Management Committee, the material risks and opportunities which ECOVE may face are determined, and effective actions are adopted to manage risks or harness the possible opportunities so as to strengthen the operational system and competitiveness of the Company and its subsidiaries.

Climate Indicators and Targets

Greenhouse Gas Management:

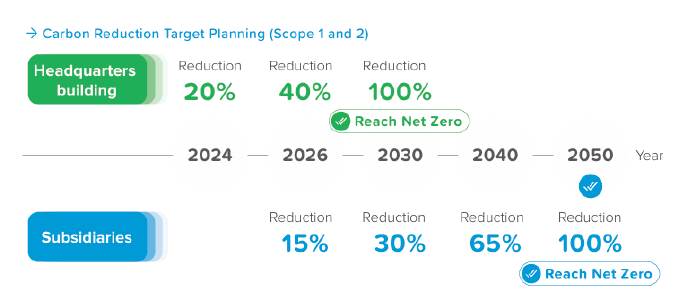

In response to the issue of climate change, ECOVE has initiated greenhouse gas inventory operations starting from 2022 as the base year. Each year, the Company completes the inventory for the previous year covering Scopes 1, 2, and 3, and commissions a third-party organization to conduct external verification to ensure the accuracy of the data and the credibility of the disclosures. ECOVE adheres to the greenhouse gas reduction targets set forth by the Science Based Targets initiative (SBTi), in which its parent company, CTCI Group, is an active participant. This initiative aims to limit global warming to within 1.5°C and establishes a scientifically-based carbon reduction pathway. Furthermore, ECOVE aligns with the objectives promoted by the Net Zero Emissions Alliance, committing to achieve net zero emissions at its office locations by 2030 and at its production sites by 2050.

In addition, ECOVE actively participates in domestic and international climate action initiatives, such

as the Carbon Disclosure Project (CDP), to enhance the transparency of climate-related information

and strengthen the Company's ability to identify and manage climate risks.

The emission intensity targets for each area are described below:

Waste removal:

The self-managed waste transportation segment has regularly conducted organizational greenhouse gas self-inventories, with 2022 as the base year. The average fuel consumption of 500,000 kilometers is calculated at 167.3 kiloliters, which serves as the basis for emission intensity control. The total emission intensity in 2022 was 454.898 metric tons of CO2e per 500,000 kilometers. In 2024, carbon emissions were 403.444 metric tons of CO2e per 500,000 kilometers, representing a reduction of approximately 11.3% compared to the baseline year. Since Scope 1 accounts for about 99% of the emissions from the waste removal sector, we will continue to control the intensity of Scope 1 emissions from waste removal by upgrading to the latest energy-efficient vehicles.

In 2024, the total carbon emissions per ton of waste at the incineration plant were 441 kilograms of CO2e. Theaverage carbon emissions from waste treatment per ton of garbage in the base year of 2022 were 456 kilograms of CO2e, representing a decrease of 3.5%. The goal is to maintain a reduction of 1% per year until before 2030.

Recycling and reuse sector:

In the base year of 2022, the total greenhouse gas emission intensity of IPA recycled products was 12.07 kilograms of

CO2e per thousand New Taiwan Dollars. In 2024, the emission intensity was 9.71 kg CO2e per thousand New Taiwan Dollars, representing a reduction of approximately 19.53% compared to the base year. Due to the upgrade of equipment or the installation of variable frequency drives in 2024, energy efficiency has been improved, resulting in a decrease in total emission intensity.

Renewable energy sector:

In the base year of 2022, total solar photovoltaic greenhouse gas emission intensity was 0.67 kg CO2e per thousand New Taiwan Dollars (Scope 1 emission intensity was 0.01 kg CO2e per thousand New Taiwan Dollars, and Scope 2 emission intensity was 0.66 kg CO2e per thousand New Taiwan Dollars). In 2024, carbon emission decrease by approximately 11.42% compared to the base year. The short-term objective is to reduce purchased electricity by utilizing self-generated power for newly established projects. Additionally, we will continue to adopt power generation modules with higher average power output per unit area to enhance generation efficiency and further develop solar photovoltaic projects to increase green energy production. Secondly, the goal of reduction will be achieved by purchasing renewable energy certificates.

Greenhouse gas emission-related risks in each sector:

Waste collection:

- Scope 1: Mainly derived from emissions generated by fuel consumption of waste collection vehicles. An increase in the number of vehicles due to changes in waste collection volume leads to an increase in greenhouse gas emissions.

- Scope 2: Emissions originating from the electricity used in offices, with relatively low-risk concerns.

Waste incineration:

- Scope 1: Emissions will be affected by changes in the amount of waste entering the plants during the year, the nature of the waste, and the actual heating value.

- Scope 2: Main emissions are those generated by purchased electricity, which is related to the operation of the incinerator for the year. If the efficiency of the power generation is good in a year, there is no need to purchase electricity, and correspondingly the risk of emissions is relatively low.

Recycling

- Scope 1: The primary source of emissions is natural gas used in the process stage gas boilers.Increased processing volume will result in higher gas consumption and, consequently, increased emissions.

- Scope 2: Emissions originate from purchased electricity, mainly related to the process stage distillation units. Changes in processing volume will also affect emissions due to the associated electricity consumption.

Renewable energy

- Scope 1: The main source of emissions is fuel consumption from government vehicles. To reduce emissions from fuel consumption, the vehicles can be replaced with hybrid or electric vehicles. There are relatively low emission risks in this scope.

- Scope 2: Emissions primarily result from purchased electricity for charging stations and monitoring systems. There are minimal emission risks in this scope.

Promoting Internal Carbon Pricing:

To enhance the integration of climate action with operational strategy, ECOVE has introduced an internal carbon pricing system in 2024. This system encompasses Scope 1 and Scope 2 greenhouse gas inventories, employing a shadow price of NT$300 per metric ton of carbon dioxide equivalent for management purposes, with formal implementation planned for 2025. This mechanism incorporates carbon costs as a deduction in the financial objective KPI for gross profit margin achievement rate, and discloses it in management reports, thereby strengthening the integration of carbon costs with operational decision-making. This system aims to promote cost-benefit analysis to advance low-carbon investments and enhance energy efficiency. It also incorporates climate-related issues into decision-making and risk assessment processes, conducts investment analysis testing, and adjusts strategic financial planning. This approach enables the identification of low-carbon opportunities and regulatory changes, gradually achieving climate strategies and objectives.

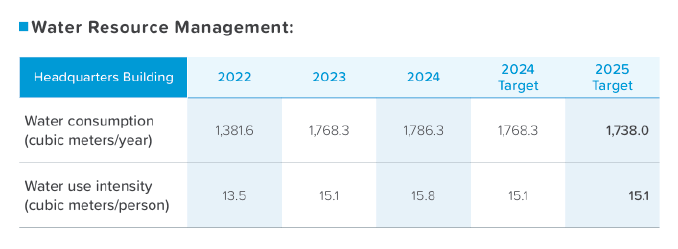

Resource Management: